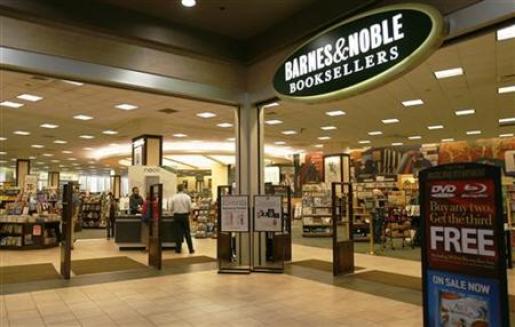

The top bookseller in the United States, Barnes & Noble, isn’t quite sure what to do with itself. What’s their key to survival in a world that may be moving beyond books as a popular way to get summer reading done? Is it to diversify? Is it to work harder at selling the Nook? Is it to go private? No one’s really sure, especially B&N itself; that’s why Barnes & Noble has decided to give up and put itself up for sale. The trouble is, nobody is sure what it’s worth since everybody’s moving to digital books and e-readers.

“How do you value an asset for the future when the entire market is being essentially turned upside down?” said Forrester analyst James McQuivey. “This could make strategic sense for them, yes. But I don’t want to exactly say it’s a good decision,” stated Morningstar analyist Peter Wahlstrom.

Just because nobody knows what to do with it doesn’t mean no one is interested. B&N may take itself private, in an attempt to move more aggressively towards ebooks. Ron Burkle, an investor who owns a controlling interest in B&N stock, is feuding with current CEO Leonard Riggio over a seat on the board of directors. Meanwhile, there’s talk that Borders Group (B&N’s traditional rival) might end up merging with their larger compatriot in the book sales industry.

Welcome to the post-book world.

Tags: Barnes and Noble, Barnes & Noble, B&N, Barnes & Noble for sale, book seller for sale, bookstore chain for sale, Ron Burkle, Borders Group, book retailer for sale